新用戶登錄后自動創(chuàng)建賬號

登錄

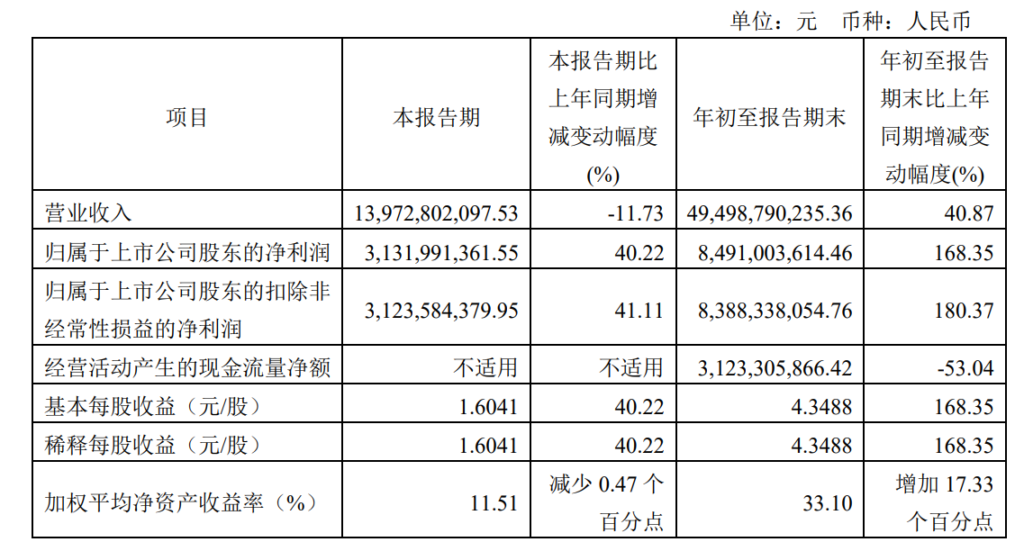

China Duty Free Group (CDFG) parent company China Tourism Group Duty Free Corp posted a strong third-quarter performance with net profit rising by around +40% year-on-year to CNY3.13 billion (US$488.9 million).

That result, boosted by exceptional items (see below) came despite an -11.73% year-on-year (and -20% quarter-on-quarter) softening in Q3 revenues to CNY13.97 billion (US$2.18 billion), with offshore duty free sales in Hainan island negatively hit by the impact of the Q3 COVID-19 outbreak on the Mainland.

Goldman Sachs Equity Research estimated that the group’s sales in Hainan fell -35% quarter-on-quarter based on an 89% market share (lower than the 95% and 91% of Q1 and Q2 due to the proliferation of retailers in 2021).

The chart shows a near -12% year-on-year softening of sales due to the Q3 COVID-19 outbreak on the Mainland but 2021 has still been a stellar year for the world’s number one travel retailer in both revenue and profit terms

China Tourism Group noted that profits had been boosted by several exceptional items. These included a CNY740 million (US$115.6 million) writeback in tax expense due to an easing of the Hainan tax rate from 25% to 15% backdated to January 2020. Following “equal and friendly consultations”, the group also benefited from a CNY1.14 billion (US$178.1 million) waiver of its Minimum Annual Guarantee (MAG) payment due to Beijing Capital International Airport for the period 11 February 2020 to 10 February 2021 due to the pandemic (as reported, CDFG also reached positive outcome from its MAG negotiations with Shanghai Airport Authority at the start of the year).

China Tourism Group also benefited from CNY0.1 billion (US$156 million) in government subsidies and tax expenses.

Commenting on the results, Goldman Sachs said: “Excluding these one-offs, its core net profit would have fallen by -49% q-on-q to RMB1.24 billion (vs. RMN2.4 billion in 2Q21), below our estimate of RMB1.5 billion, due to weaker-than-expected margin trend.

“We had anticipated the company to report lower revenue (-20% q-o-q) driven by lower Hainan DFS sales amid the wide spread of the Delta variant. But the magnitude of actual margin contraction was sharper than we had expected, -6.3pts q-o-q to 31.3%, which management attributes to more promotional activities, especially in late July-August, when Sanya suffered from COVID-19 resurgence [on the Mainland, with overnight visitation falling as much as 60% month-on-month.

“On a positive note, management said that both revenue and margin have noticeably recovered in September. From our previous discussion with an industry expert, we suspect part of the pricing discount would also be borne by the brands.”

Goldman Sachs noted the improved result in CDFG’s online sales in Q3 after one to two quarters of weakness. Based on subtracting Hainan DFS sales from total revenues, Goldman Sachs estimated that Q3 online sales rose 30+% quarter-on-quarter, reflecting heightened development work in that sector and the recent formation of CDF Sunrise Internet Technology Co Ltd.

For the first nine months, revenue climbed +40.87% year-on-year to CNY49.498 billion (US$7.73 billion) with net profit soaring +168.35% to CNY8.49 billion (US$1.33 billion).